Archive for category: Uncategorized

A Growing Layer of Union Activists …

The first thing on everyone’s mind at the conference was the sheer size of the thing. Four thousand people registered. It was a sold-out crowd, and the biggest ever at a Labor Notes conference. Almost every session I went to was overflowing: the chairs were all filled; the walls were lined with bodies; people crouched in all the aisles.

It’s a key point because Labor Notes is one of the ways the most committed, energized rank-and-file activists in the labor movement — representing a swathe of industries and unions across the country and the world — gather themselves and talk to each other.

The fact that this was the biggest Labor Notes conference means that that active, energized layer of activists — helping drive union struggle across the country — is growing.

Not only is it growing, it’s discussing how to fight in a militant, disruptive way.

Striking was a key topic. The Teamsters are preparing to negotiate a contract next year at UPS, and it seems like a UPS strike is on the horizon. Two members of the caucus Teamsters for a Democratic Union gave a seminar on Saturday afternoon on how to prepare a strike, based on their own experience in 1997. The panel also explored how to strike during a contract too — something labor bureaucrats have been terrified of for decades.

Another panel explored how to strike without a contract. There, a panelist said labor law is not the source of power — and he’s right. Our power comes from how well we can organize and squeeze the profits we make for the bosses, he said — not waiting for the government to save us. In the same vein, Joe Burns — author of the new Class Struggle Unionism and part of the leadership of the AFA-CWA union — called for a “class struggle unionism” unafraid to break laws when it strikes.

These are all ideas reaching a growing layer of union activists now. And many of the labor activists hearing these ideas were young, and often queer — part of “generation U,” as I’ll say again later, who don’t have the huge weight of an old bureaucracy teaching them to be “careful,” to avoid strikes, to play it safe.

… and a Radical Layer

But it’s not just that the conference was huge or that it was throwing around militant ideas. It’s also that, again and again, it seemed like the huge audiences were far more radical, far more to the left, than many of the panelists themselves. Again and again, they drove the conversation in more radical directions.

For example, not a single official panel title or description on the Labor Notes conference program mentions socialism. But at every panel I saw, the audience brought up socialism and said (in one way or another) that socialism is the goal of our fight.

Another example. One panel said it would tackle how unions should relate to the problem of the murderous, racist police. On that panel sat a member of a nonprofit in Minneapolis. He stood up to talk about how to reduce the tensions between communities and the police. He said, “Well, we know, not all cops are bad, some are really good people.” The audience jeered him: “Fuck 12! Fuck the police!”

During the Q&A, one of my own Left Voice comrades — a rank-and-file activist from SEIU in Los Angeles — stood up. She pointed out that cops aren’t just the descendants of slave catchers. They’re strikebreakers, enemies of every real union. Cops have no place in the labor movement, and we need to kick them out of all our unions and federations to strengthen the movement, she said — to wide applause.

It was just after this that a Minneapolis activist — identifying themselves as queer and Black — stood up. They pointed out the ways that nonprofits worked overtime in the wake of the huge 2020 uprising to co-opt the struggle for racial justice, to rob the movement of its radical energy, and to channel it in safer directions — then led us in Assata Shakur’s chant: “It is our duty to fight for our freedom. It is our duty to win. We must love and support one another. We have nothing to lose but our chains.” The crowd cheered them on.

All this seems like an important change from other kinds of LN meetings. In 2021 — just one year after the biggest social movement in history, which was a struggle against racist police — I went to Labor Notes’ “Troublemaker School” in Philly. It was nothing like this.

It was big. But by comparison, it was much tamer. The only session on racial justice and unions was like an HR session from my boss. It called for us (individually) to be anti-racist in our unions — surely a good message. But never did the speakers talk about our own unions’ role in fighting the murderous, racist cops. I raised the issue, but it fizzled.

In fact, the content of our discussions at this year’s conference was a major move to the left from Labor Notes as an organization. The pages of LN never, or almost never, hazard a mention of socialism. They don’t dare criticize the Democrats like even some of this year’s panelists did (I’ll mention them in a minute).

At least part of the reason might be “Generation U” — the new layer of young, often queer, activists driving the new unions. The Starbucks and Amazon unions were a major presence — not only were many of their activists there, but they were the equivalent of labor “celebrities” — cheered at every chance. And we know that younger people are far more likely to be deeply critical of capitalism and open to socialism.

Powerful Contradictions …

But this conference was a showcase for powerful contradictions in this layer of the labor movement — especially around politics.

People were grappling with the problem of the Democratic Party. At multiple sessions, activists raised major, and crucial, critiques of the Democrats — a party that has betrayed, constantly, the labor movement. The highest pitch of that critique came from Joe Burns, at a panel on his new book.

There, for example, Burns pointed out just how toothless and cynical the Democrat promises of the PRO Act are. Those promises face the combined power of U.S. judges who side with the ruling class, not workers. Even if that law could be passed — it almost certainly can’t be — judges are standing by ready to interpret it in the narrowest, most useless way possible. And the Democratic Party came up again in a workshop about organizing and bargaining around abortion rights. Several attendees brought up being let down for decades by the Democratic Party, and the need for a mass movement, led by the labor movement, to win abortion rights in the United States.

But there’s a deep reluctance at the top of our unions to take this logic to its natural end — calling for cutting our unions’ ties to the Democrats and building an independent party for the working class. At a panel that Sara Nelson facilitated, the room was again overflowing. People stood and crouched for lack of chairs in a massive space that could hold hundreds. At one point Nelson blasted the Democrats. She pointed out just how badly Democrats and Republicans both had betrayed labor.

So a comrade of mine in Left Voice put out the obvious point: If the Democrats are so awful to labor, let’s cut ties, let’s create our own, independent party! It was an idea that was met with mad clapping and shouts of agreement.

Nelson grabbed the mic — and waffled. “Workers don’t need their own party. If they have more power over production, the parties will come to them!”

But this is astonishing. It flies in the face of history. Even when unions were much bigger — in the 1950s and 1960s — Democrats worked overtime to co-opt, limit, restrict, and betray the movement. For just one example: Democrats and Republicans stood arm in arm in 1947 to pass the Taft-Hartley Act, which radically undercut and hemmed in the ways unions could legally strike.

We see the same contradiction in the fact that, at this meeting for labor rank-and-filers, the LN staff spent so much time and energy preparing for speeches by a Democrat — Bernie Sanders.

Bernie is definitely a reason many young people to socialist ideas. He surely has their ear. But that situation is full of contradictions, too. Despite all this, he serves a party that has refused to lift a finger for labor, that helped usher in the neoliberal revolution against labor, that champions the bombing and murder of working-class people around the globe. In 2020 his run for president helped gather these radical forces on the U.S. Left — but only to endorse Biden, who opposes key working-class struggles: for police abolition, to put up a real fight for abortion rights in the streets — and on and on. Whether he wants to or not, Bernie is helping keep this dynamic going, helping pull radicals into the the Democratic Party, the graveyard of social movements.

And we see a contradiction in how Labor Notes relates to union bureaucracy too. Labor leaders have played a major role in tamping down real rank-and-file struggle — exactly the kind of struggle Labor Notes exists to stir up. And far from shrinking in recent years, that bureaucracy has been exploding in size and power over rank-and-filers.

Surely that bureaucratic system has major contradictions of its own. Nelson isn’t the same kind of leader as the late Richard Trumka. In fact, it was Burns — in the leadership at AFA-CWA with Sara Nelson — who criticized most labor leaders during his panel (and in his book Class Struggle Unionism). But even though the idea of union democracy was much discussed — as it should be! — the critique of bureaucracy, what it is, how it exerts its power, how it tries to control the rank and file — was curiously muted in most of the sessions I went to, as it is on the pages of Labor Notes too.

But all this shows that something important is happening — symptoms of something much larger.

… and Powerful Possibilities

What’s most important in all this isn’t just the lack of imagination in even a stirring, brilliant speaker like Nelson, or the limits of Sanders.

What’s important is that people like Nelson and Burns, and Bernie too, are bellwethers — or canaries in coal mines, or tuning forks — registering something bigger than them, that doesn’t quite have its voice yet — something new, and possibly powerful, at work in a dark way inside labor itself.

It’s true that unions’ bureaucratic leaders have spent many decades in a love affair with Democrats. But this is true even of a more leftward union leader like Nelson, who endorsed Biden in 2020. Still, the fact that Nelson did not champion the Democrats at the conference is a kind of ripple, on the surface, of a force from below requiring her to shift. Labor Notes became — in many cases despite the official programming — a place to critique the Democrats and, at least here and there, tentatively, to think about alternatives.

And the same goes for Labor Notes as a whole. The big, roiling mass audience was constantly surging past the more restricted, narrower limits of Labor Notes as an organization. Here we see a hidden power struggling inside the most energized layers of unions.

Something is stirring inside labor. The goal now is for us to fight to help give it shape and expand its power: for a radical, militant force in the labor movement, breaking free from all capitalist political parties, struggling for radical, bottom-up control of unions — to build a labor movement that could really fight for the overthrow of this rotten system and the building of socialism.

The post Something Big Is Stirring: Report from the 2022 Labor Notes Conference: appeared first on Left Voice.

The Supreme Court’s conservative majority is waging a full-scale war on modernity. On Friday, the court’s six conservative justices ended the constitutional right to abortion that had allowed American women to enjoy full citizenship and equality (at least in theory) for nearly 50 years. We often talk about legal efforts to undo abortion rights with the phrase “setting back the clock.” That understates the radical project that today’s Supreme Court is undertaking.

To justify overturning Roe v. Wade, the conservative majority argues that abortion is not a right grounded in our history and traditions. Because the right to abortion rested largely on the guarantees of the 14th Amendment, which was adopted in 1868, Justice Samuel Alito notes in his majority opinion that the morality of the 1860s should be applied to pregnant people today.

“By the time of the adoption of the Fourteenth Amendment, three-quarters of the States had made abortion a crime at any stage of pregnancy, and the remaining States would soon follow,” he writes. Alito then takes his time machine back to 13th century England to build his case that abortion is not, historically, part of our tradition.

It doesn’t take a genius to poke holes in the logic here, or even question this framework. As the three dissenting liberals on the court point out, women were purposefully excluded from both the Constitution and the 14th Amendment by the men who wrote them. “Those responsible for the original Constitution, including the Fourteenth Amendment, did not perceive women as equals, and did not recognize women’s rights,” the dissent states. “When the majority says that we must read our foundational charter as viewed at the time of ratification (except that we may also check it against the Dark Ages), it consigns women to second-class citizenship.”

In other words: the majority’s reliance on the laws of centuries yore is not a bug, but a feature. Alito and his fellow conservatives on the court have embraced “history” to justify their decisions. History here belongs in scare quotes because the goal of a historical test for the court here seems to be to pick and choose the artifacts they want.

Alito and his fellow conservatives on the court have embraced “history” to justify their decisions. But the goal of a historical test for the court here seems to be to pick and choose the artifacts they want.

Alito did not choose, for example, to understand the 14th Amendment as a rejection of the forced pregnancies of enslaved people. There is ample historical evidence that the framers of the 14th Amendment intended the text to bestow upon freed Americans the right to choose when and with whom to create a family after slavery’s practice of rape, forced birth, and family separation. Nor did Alito choose to interpret English law from the Middle Ages that banned abortion after about 18 weeks gestation as pretty comparable to Roe’s viability framework; instead, illogically, he framed this history as a reason to overturn the right to abortion.

On Thursday, just 24 hours before the court overturned the 49-year-old Roe, the conservative majority invalidated New York state’s century-old law regulating licenses to carry concealed guns. Though New York’s law was enacted in 1913, apparently it was too modern for this court. Justice Clarence Thomas wrote that this old law did not fit the nation’s history, then set out a new test for gun legislation that must be based solely in history; his chosen “history” apparently starts and ends sometime before 1913. Once again, “history” is a self-serving exercise in cherry-picking. Thomas himself virtually admits to that by dismissing laws he deems too old and others that simply contradict his view. Within 24 hours, this cherry-picking has led to the contradictory situation of Thomas dismissing 13th century British common law to overturn a gun restriction, followed by Alito citing 13th century cases to justify overturning Roe.

But the contradiction is not the point. Rather, it’s what this hypocrisy demonstrates: that the Supreme Court will use whatever means necessary to take away what makes the United States a modern, functioning democracy. History is the tool, but only when it serves that goal. In his concurrence overturning Roe, Thomas explicitly called for overturning settled decisions that grant a right to contraception, intimate sexual relations, and same-sex marriage—all part of what makes us a modern society rather than a 19th-century style theocracy.

This is not a new project. Nine years ago, Justice John Roberts gutted the 1965 Voting Rights Act. This law is the lynchpin that actually guaranteed the right to vote to Black Americans, arguably helping America live up to its democratic potential. That right has been in retreat ever since.

It’s not just modern individual rights but also our modern government that are now on the court’s chopping block. Next week, the Supreme Court will decide a case about the federal government’s ability to fight climate change. That the Supreme Court is even considering this case is a prime example of its radical agenda and the haste with which it is already ushering it into existence.

At issue is the Clean Power Plan that President Barack Obama’s administration wrote but that is not being implemented any longer. Normally, you need an injury or at least a threat of one to be able to even bring a case to the Supreme Court. Yet this Supreme Court is expected to rule against a policy that isn’t injuring anyone since it is not even in force, in order to take a swing at the modern administrative state.

Suing to stop a policy that literally no longer exists, Republican attorneys general are asking the Supreme Court to limit the Clean Air Act and Congress’ authority to delegate policy decisions to the Environmental Protection Agency. It sounds boring and wonky, but the basics are these: With this case, the court is poised to roll back what federal agencies can regulate, including threats as existential and enormous as climate risk. It’s a regular theme for this court, and this case was clearly so tempting to the conservatives that they took the case even when it should be, as the justices like to say, moot.

This attack on the administrative state may sound small. But it heralds an ominous shift. At its founding, the United States did not have much of an administrative state. Certainly no EPA, not even a Justice Department. Over the last 200 years, Congress has slowly created agencies with the power to function as a modern government overseeing a large and complex country. While bureaucracy is imperfect and frustrating, it funds the vaccines we need during pandemics, ensures our rights, protects our air and water, regulates industries, collects taxes—the list is long, all the way down to trying to save the continued habitability of the planet. A government with a weak and shrunken administrative state cannot protect you—not the air you breathe or your right not to face discrimination or your ability to vote.

Yet with each new opinion, narrowing those protections seems to be the goal. The six conservatives on the Supreme Court will go as far back as they have to—to the 13th century even—to peel away the rights and structures that underpin modern life.

In February 1848, the workers of Paris overthrew their king and founded the Second French Republic. Months later they would rise again, in what became known as the ‘June Days’, which Karl Marx described at the time as “the greatest revolution that has ever taken place…a revolution of the proletariat against the bourgeoisie”.

The workers went down to defeat in June 1848. But their heroic struggle passed down a legacy and lessons which remain extremely valuable to workers of today.

The July monarchy

France in the 1830s and 1840s lived under the so-called ‘July monarchy’ of King Louis-Philippe. The regime was a hotbed of corruption.

France in the 1830s and 1840s lived under the so-called ‘July monarchy’ of King Louis-Philippe. The regime was a hotbed of corruption.

Through the ever-expanding national debt and the distribution of contracts for public works, the ministers “piled the main burdens on the state, and secured the golden fruits to the speculating finance aristocracy”, in Marx’s words. This state of affairs will feel very familiar to anyone living in Britain today.

The young working class was ruthlessly exploited under this ‘bourgeois monarchy’, often working 14 – or even 18 – hours a day, earning barely enough to survive. The lack of housing meant that workers and their families were crammed into tiny rooms, forced to live in the most squalid conditions imaginable.

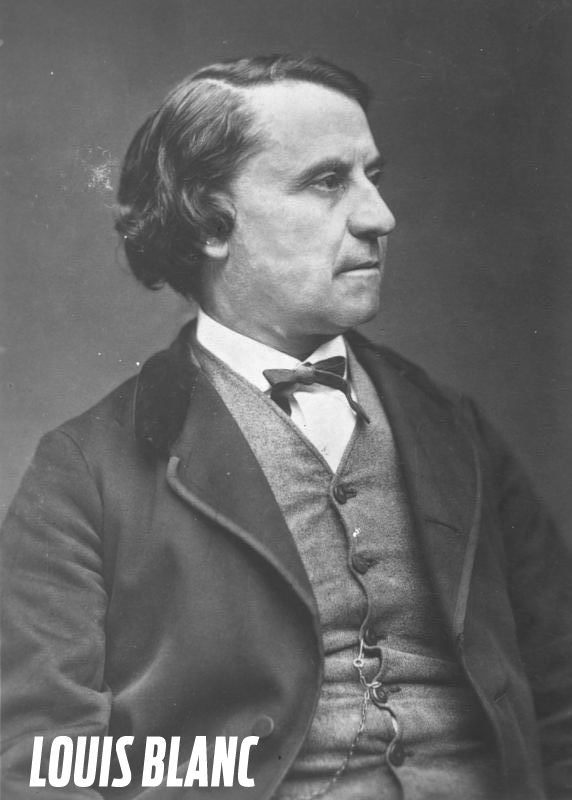

But it was also in this period that the workers began to forge their own organisations and education societies, where the ideas of socialism were eagerly debated. The most well-known socialist of the 1840s was Louis Blanc, who published his best-known work, The Organisation of Labour, in 1839.

Taking up the ‘right to work’ – an idea first put forward by utopian socialist Charles Fourier – as his slogan, Blanc called for the creation of ‘social workshops’ by the state, which would offer employment to all.

The February Revolution

France was rocked by a deep economic crisis in 1846 and 1847. In this context of instability, the liberal opposition resolved to strengthen its case for electoral reform by appealing directly to the people, or at least the respectable middle classes, who would stand to gain from their modest extension of the franchise.

France was rocked by a deep economic crisis in 1846 and 1847. In this context of instability, the liberal opposition resolved to strengthen its case for electoral reform by appealing directly to the people, or at least the respectable middle classes, who would stand to gain from their modest extension of the franchise.

The monarchy’s draconian anti-assembly laws, however, made it impossible for them to hold political meetings or rallies. Instead, they announced a campaign of ‘banquets’, in which attendees would pay an entrance fee to receive some food, wine for toasts, and then be harangued by a handful of well-known speakers.

The first banquet of the campaign took place in Paris in July 1847. Immediately, the campaign came under the influence of the more radical ‘Democrats’, who were supporters of universal suffrage.

As the campaign progressed, the workers were also drawn into the political struggle. But in addition to the vote, they also raised their own social demands, just like the British Chartists. At a banquet in Chartres for example, ‘the organisation of labour’ was raised as a demand alongside universal suffrage.

In parliament, the banquet campaign had done nothing to break the resistance of the government. In an atmosphere of escalating tension, liberal deputy Alexis de Tocqueville offered the following warning:

“This, gentlemen, is my profound conviction: I believe that we are at this moment sleeping on a volcano.”

When the authorities banned the last of the banquets, in Paris on 22 February 1848, this volcano erupted.

In the working-class districts of the city, arms shops were looted and barricades began to be built immediately. The next morning, the National Guard was called out to restore order. But instead they came chanting ‘Long live reform!’

The king dismissed the government, hoping to quell the revolt. But this only urged the masses on. When a column of protestors carrying a red flag pressed up against a line of infantry, the troops fired directly into the crowd. Fifty-two were killed on the spot.

The workers were enraged by the massacre, pledging, ‘Vengeance!’ From this point the fate of the monarchy was sealed.

By the next day the city was under the control of the armed working class. As the abdication of the king in favour of his nine-year-old grandson was being announced, the parliament was invaded by the revolutionary workers, who forced the proclamation of the Republic.

The workers betrayed

At all stages of the revolution of February 1848, the initiative belonged to the working class.

At all stages of the revolution of February 1848, the initiative belonged to the working class.

It was the workers who built and died on the barricades. And it was the workers who forced the proclamation of the Republic. But the class that was brought to power as a result of this workers’ revolution was not the working class. Nor did their representatives even obtain a majority.

The Provisional Government which was handed power on 24 February was overwhelmingly made up of ‘pure’, or ‘moderate’ republicans, with a couple of socialists like Louis Blanc tacked on under pressure from the workers.

The workers’ insurrection had placed its enemies in power. Leon Trotsky called this the “paradox of the February Revolution” in 1917, which applies just as well to February 1848.

On the streets of Paris, meanwhile, the armed workers remained the almost undisputed power. And having conquered the Republic, they naturally sought in it their liberation from poverty and oppression.

At noon on 25 February, day one of the new republic, a detachment of armed workers marched to the Hôtel de Ville. One of their number slammed the butt of his musket on the floor and demanded: “Droit au travail [right to work]”.

Blanc, seeing his own slogan menacingly thrust at him, immediately drafted one of the first decrees of the provisional government:

“The provisional government of the French republic pledges itself to guarantee the means of subsistence of the workingman by labour.

“It pledges itself to guarantee labour to all citizens.”

The same decree announced the creation of ‘national workshops’ to provide employment for all.

Overnight, the workers of Paris had effectively made Louis Blanc’s programme the law of the land, much to the surprise of its author. But Blanc himself was kept as far from the means to realise it as possible. Instead he was given a ‘commission’ to look into the question of the organisation of labour, without any power or budget to offer any practical solution.

Meanwhile, 100,000 unemployed workers were enrolled into the national workshops. But the task of finding and organising the work for this army of unemployed was given not to Blanc, but to Alexandre Marie, who was hostile to socialism.

Enrolled workers were given projects such as levelling the Champs de Mars. Employment on more useful projects such as building railways or canals was rejected by the government.

Unsurprisingly this arrangement pleased no one. Respectable society was scandalised by the sight of thousands of workers being paid public money in return for enforced idleness, while the workers themselves were bitterly disappointed.

For them, the ‘right to work’ signified not charity, but the organisation of production in order to guarantee useful work to everyone in accordance with their skills. What they wanted, in essence, was socialism. What they got was grimly described by Marx as “English workhouses in the open”.

The revolutionary clubs

One of the most inspiring products of the February Revolution was the club movement. The ‘clubs’ took their name from the clubs of the Great French Revolution. But they possessed a very different class content.

One of the most inspiring products of the February Revolution was the club movement. The ‘clubs’ took their name from the clubs of the Great French Revolution. But they possessed a very different class content.

Even the most radical clubs of the first revolution were a largely bourgeois affair. The clubs of 1848, on the other hand, were a cross between workers’ assemblies and political parties. They would meet regularly to discuss the pressing matters of the day, as well as questions of economic and political theory.

By mid-April there were 203 clubs in Paris alone, of which 149 were united in a single federation. They were essentially organs of workers’ democracy, growing rapidly out of the daily tasks of the revolution.

Marx described the clubs as “the centres of the revolutionary proletariat”, and even “the formation of a workers’ state against the bourgeois state”.

A key question for the club movement was that of its position in relation to the provisional government: should it support the government, albeit critically, or move to overthrow it? The majority of the Paris clubs took a conciliatory position, seeing their role as a support for and, if necessary, a check on the government.

The attitude of the Provisional Government towards the clubs, on the other hand, was more of fear and loathing, than surveillance and support.

So long as the armed workers were the main power on the streets, the Provisional Government would have to temporise, offering many concessions. But no one in the government had any illusions in this temporary state of affairs.

The government advances

The government was strengthened by the elections, which took place on 23 and 24 April 1848.

All Frenchmen over the age of 21 were eligible to vote for 900 deputies to a single National Assembly. This realised almost all of the political demands of the British Chartists, who had held a huge demonstration in London only weeks earlier.

The result was an overwhelming victory for the provisional government and the bourgeois republic. Almost every successful candidate ran as a ‘republican’ – including many monarchists! This showed the mood that existed in the country. But radical and socialist deputies only took up around 55 of the 900 seats in the assembly.

It must be remembered that the working class constituted a tiny minority of the French population at this time, and the vast majority of the electorate were peasants, living in the countryside.

A significant section of the peasantry would later shift violently to the left, but this would take time and experience. It was inevitable that at this stage the socialists would find themselves isolated.

The revolutionary workers in the clubs were disgusted by the result of the election, and began immediately calling for the overthrow of the assembly. Meanwhile, the government purged itself of its socialist members, Blanc and Albert, and prepared for war.

On 24 May, it was announced that the workers enlisted in the national workshops would either be drafted into the army or forced out of Paris.

The workers were faced with the dissolution of their organisations, deportation, and destitution. On 22 June, Louis Pujol, a lieutenant in the workshops, led a demonstration to the Ministry of Public Works and confronted the minister, Marie, who told them: “If the workers don’t want to go to the provinces, we shall make them go by force.”

That evening Pujol addressed a mass meeting at the Panthéon. “The people have been deceived!” he cried. “You have done nothing more than change tyrants, and the tyrants of today are more odious than those who have been driven out…You must take vengeance!”

The June Days

On 23 June, barricades began to rise in Paris. By noon, almost all of the eastern part of the city was under the control of roughly 50,000 insurgents – although the armed fighters were undoubtedly supported by an even broader layer of the working-class population.

On 23 June, barricades began to rise in Paris. By noon, almost all of the eastern part of the city was under the control of roughly 50,000 insurgents – although the armed fighters were undoubtedly supported by an even broader layer of the working-class population.

At the same time, the National Guard had been called out. But the response was extremely mixed. In eastern Paris, National Guardsmen allowed themselves to be disarmed by the workers or actively joined the insurrection. In the wealthier, western part of the city, however, the response to their orders was emphatic.

By eleven o’clock that evening, there were already 1,000 dead, with no end to the fighting in sight. All of the most prominent workers’ leaders either betrayed, or were killed, arrested, or in exile. Not a single socialist or radical deputy in the National Assembly supported the insurrection.

The ‘democratic socialist’ paper, La Réforme, explained, “We were ardent revolutionaries” under the monarchy, but “we are progressive democrats under the Republic, with no other code but universal suffrage”.

Louis Blanc signed a declaration calling upon the workers to throw down their “fratricidal weapons”, alleging they were “victims of a fatal misunderstanding”.

In theory, Blanc saw the democratic republic as a means of emancipating the working class. But in practice, his faith in the bourgeois state led him to defend it above all else, even against the very workers it was supposed to serve. This fatal flaw of reformism would return to haunt the working class time and time again throughout the world.

A state of siege was officially declared in Paris, and General Eugene Cavaignac was invested with dictatorial powers to defeat the insurrection.

Engels reported: “Today…the artillery is brought everywhere into action not only against the barricades but also against houses.” Many captured insurgents were shot on the spot and thrown into the Seine.

In contrast, in the areas under their control, the workers maintained perfect order. Only the gun shops were looted, and prisoners taken during the fighting were often set free.

New from Wellred! Series of 3 key writings by #Marx on France: ‘The Civil War in France’ – Marx’s analysis of the #ParisCommune – ‘The Class Struggles in France’ and ‘The 18th Brumaire’. Pre-order series for a discount price: https://t.co/OpARKUqyPH #ParisCommune150 #Socialism pic.twitter.com/SIOBsHFS6I

— Wellred Books (@WellredBooks) March 15, 2021

Defeat

Crucially, the workers fought alone. This fact, above all, determined the result.

The February Revolution had been led by the workers. But it was supported by a decisive section of the small property owners and artisans of Paris, who constituted the majority of the city’s population at the time. In June 1848, this ‘petty bourgeoisie’ sided with the defenders of private property against the workers.

In the meantime, up to 100,000 volunteers from the rural provinces were flooding into the city, travelling from as far as 500 miles away to fight against the insurrection. Blasted by explosive shells and surrounded on all sides, the insurrection began to retreat.

On the third day, the tide began to turn against the workers. And on Monday 26 June, the last barricade was cleared by Cavaignac’s troops. The Paris workers, isolated, without centralised leadership or artillery of their own, had held out for four full days against the full military might of bourgeois ‘civilisation’.

The government reported 708 casualties. The total number of insurgents was not accurately reported, but likely mounted into the thousands. Thousands more were deported to penal colonies in Algeria.

Paris had never seen such bloody fighting, which would only be surpassed by the crushing of the Paris Commune in the ‘bloody week’ of 21-28 May 1871.

What distinguished June 1848 from all previous insurrections was not only its scale. The June Revolution was arguably the first time the proletariat assailed the class rule of the bourgeoisie directly, in its own name.

That the workers and their leaders, experimenting and groping their way forward, made mistakes is undeniable; such is the lot of all pioneers.

This was still an early stage in the development of the working class. Not only was there no real party of the working class at this stage, even the trade union movement was under-developed and largely limited to specific crafts.

But that they came so close to victory, at a time when they constituted a minority even in Paris, let alone in the rest of France, is much more significant.

The workers had learned and achieved more in just over three months than in the preceding three decades.

Having won the democratic republic, the workers immediately sought to use it for their own ends. Blocked by the very institutions they had brought into being, they created their own democratic organs for the conquest of power and for the socialist transformation of society.

And in their defeat, the workers had passed down an immense revolutionary legacy.

Workers’ power

The titanic events of June 1848 also had an extremely important impact on the development of Marxism.

The titanic events of June 1848 also had an extremely important impact on the development of Marxism.

Drawing directly from the experience of the Paris workers, Marx issued an address to his organisation, the Communist League, in 1850. In it, he insisted that in a future revolution:

“Alongside the new official governments [the workers] must simultaneously establish their own revolutionary workers’ governments, either in the form of local executive committees and councils or through workers’ clubs or committees.”

Further, he explained that the aim of these councils or clubs should not be to support the official government, but to expose and eventually overthrow it, establishing what he termed “the dictatorship of the proletariat” – the class rule of the workers.

“Their battle-cry”, he concluded, “must be: The Permanent Revolution.”

Eventually, what June 1848 had only decreed in words was eventually carried out in practice by the Paris Commune of 1871: the first workers’ state in history.

These lessons were also studied carefully by Lenin and Trotsky, who applied them so successfully in 1917. It is therefore no exaggeration to say there is a direct link between the defeat of the workers in June 1848 and their victory in October 1917.

Today

These events still have a lot to teach us today. Global capitalism faces the deepest crisis in its history. Already, across the globe, the masses have toppled one government after another in search of a better life. And this is only the beginning.

In Europe, a level of corruption and malaise comparable to the last days of the July monarchy can be felt by all layers of society.

Like de Tocqueville in January 1848, the most farsighted representatives of the present order see the danger ahead. The volcano of revolution threatens to erupt once again.

But the modern working class is incomparably stronger than it was in 1848. And the possibility of the socialist transformation of society has never been greater. With a revolutionary leadership, guided by the lessons of history, its victory is assured.

Workers of the world: unite!

The depth of the U.S. securities market helps ensure dollar hegemony

1. The Ukraine Crisis and Dollar Supremacy

Since the collapse of communism in the early 1990s and the subsequent rise of the world economy as a single market-based operational totality, its monetary counterpart has been a unipolar currency system centered on the US dollar as the premier vehicle currency in the private sector, as well as the premier reserve currency in the official sector. The hegemony of the dollar has survived several global economic shocks, including that of the financial crisis of 2007-9. Whether the system can survive the seismic shocks stemming from Russia’s invasion of Ukraine in February 2022 is now under active debate.

Many prominent commentators argue that it will not, noting the ongoing attempts by Russia and her trading allies to circumvent the US-led imposed financial sanctions. Barry Eichengreen, for instance, observed that because of the Russian and other central banks’ increased diversification of their reserve holdings away from the dollar “we are seeing movement towards a more multipolar international monetary system.”[1] James Galbraith sees a dual currency system in the making, as Russia and her trading allies “carve out… a significant non-dollar, non-euro” rival financial system.[2] In a wider context of innovations in technology and finance, the IMF also noted the possibility of a scenario where “the greenback could be felled not by the dollar’s main rivals but by a group of alternative currencies,” including crypto and digital currencies.[3]

This is not the first time that a geopolitical crisis has prompted musings, at various levels of the academia and the commentariat, about the coming end of dollar hegemony. Invariably, they turned out to be wrong. Given the rather long history of failed forecasts, current predictions about the dollar’s future tend to be given with more caution and hedged with various caveats and qualifications. Indeed, to be fair to Barry Eichengreen, he is careful to emphasize that dollar dominance will not end soon, even while the Ukraine crisis may have accelerated the ‘stealth erosion’ of that dominance. A more general qualifying refrain is that a multipolar currency system, while not yet here, is nevertheless in the cards.

Is it, though? Can the ongoing attempts to establish a non-dollar alternative amount to a serious challenge to the hegemony of the dollar? The contrasting answers to this question reflect two alternative visions of capitalism. The declinist school of thought on the dollar supremacy stems, as Susan Strange noted some 30 years ago, from academic traditions that have historically overlooked the importance of the financial system in shaping the balance of power. It was a result of a methodological choice: at best, they have proxied it with currency regimes that serve international trade relations. As such, the declinist school of US power (and hence the dollar) originates in the productionist vision of capitalism, where trade reflects the structure of production, and where monetary regimes of individual states reflect the position of a country in international trade flows.

An alternative approach, known as the money view of capitalism,[4] or capitalism of futurity, places the tradability of debt[5] as the core institutional setting that defines political economy generally, and, more specifically, the force that anchors major decisions and developments in production, trade, and investment. From the latter perspective, we see no end to dollar supremacy, whether rapid or gradual. As Susan Strange wrote in her seminal critique of a realist school of international relations:

“the error of the declinist school of American scholars lies in assuming that if the US has lost power, some other state must have gained it… The facts suggest that this zero-sum idea is far too simple. The US government has lost power mainly to the market.”[6]

Today, we can add, the financial market. Focusing on the trade flows and currency reserve tactics of the central banks, the declinist perspective on the global role of the dollar overlooks the central force that underpins not only the hegemony of the dollar but lies behind global financialized capitalism in general. That force is the gravitational pull of the dollar-denominated securities markets.

2. The Gravitational Pull of the Dollar

“As recent crises make clear, up to now the dollar-based order has been supported mainly by instability elsewhere and the lack of a credible alternative or compelling reason to create one, or where such reasons are felt, the ability to do so… The system has been held up, in short, by confidence in itself, and not, so far as one can see, by much of anything else.”[7]

Galbraith is correct about the importance of the lack of alternatives to the dollar, yet the problem with his argument is his reading of the cause. He sees the confidence in the dollar as something highly fragile because it apparently lacks any material substance to back it. A lack that, presumably, comes down to the gap between the US share of world production on the one hand, and its share of world securities supplies, on the other.

Between 1986 and 2019, daily forex turnover had risen from about $0.4 trillion to $6.6 trillion.[8] During this period, the dollar’s share of this turnover has averaged about 44%.[9] In today’s terms, this percentage is roughly on a par with the US’s respective percentage contributions to the world’s equity stocks (40% of the $95 trillion outstanding in 2019) and to the world’s bond stocks (39% of the $106 trillion outstanding in 2019).[10] However, it is also far above the US’s percentage share of nominal world output (23% of the 2019 world GDP figure of $88 trillion). These numbers, taken in combination with the trend increase in the US trade deficits, underpin the widely held view, shared by Galbraith, that there will soon come a time when foreign investors will lose confidence in the dollar and thus abandon it due to mounting concerns about the US ability to meet its financial obligations in the face of its deteriorating macroeconomic fundamentals.

This scenario is realistic only if one assumes that there has been no structural change in the relationship between the financial sector and the macroeconomy. Yet, citing Strange again, the addition of credit has altered the balance of power in the world economy. But not in the way that Galbraith and others envisage it.

The expansion of financial markets, the explosion of debt and asset values, are typically associated with the phenomenon of financialization. Over the past few decades, financialization has evolved at an accelerated pace; the financial sector now completely dominates the real productive economic sector on which it rests. In 1980 the combined nominal value of the world’s equity and bond stocks stood at about $11 trillion, a figure on a par with that of nominal world GDP in that year. By 2020 the combined value of those securities stocks had grown over twenty-fold to $234 trillion, while world GDP had only registered an eight-fold increase to $84 trillion in that same period.[11] The growing scale disparity between the financial sector and the underlying real sector is what ultimately fuels narratives of an impending collapse, and the declinist school on the power of the dollar forms one of those narratives.

But financializaton is not a one-dimensional force. Its depth is just as important as an indicator of its historical significance, as is its speed of development because it reflects the structural role of finance in economic transformation. To be specific, the recent scale growth of the world’s equity and debt securities markets is an outcome of fundamental changes in both their supply and demand sides.

From a supply-side standpoint, this growth manifests the radical change in corporate and government dependence on financial security issuance. Previously that dependence may have been small, or, if large, always temporary (e.g., bond issuance to finance a large-scale project or to meet the costs of an emergency). Today, it has become both large and permanent, because of the new financial pressures on corporations and governments that are rising in tandem with the increasing size and complexity of modern economies. For increasing volumes of security issuance to be possible, there obviously must be investors with a correspondingly large enough demand capacity. Chief amongst those investors are the institutional asset managers, the pension and mutual funds, and insurance companies.

Once a small cottage industry catering to the wealthy, over the past four decades asset management has in many countries become a mass industry catering to the retirement and other welfare arrangements of large sections of the population. Along with this growth in asset management scale has come a corresponding growth in the need for investable assets – most notably, for equities and bonds. Although there are other types of assets that serve as stores of value for asset managers, the exigencies of their role as financial intermediaries mean that it is financial securities that necessarily comprise the majority proportion of their asset holdings. What sets these securities apart from other asset classes is their ability to combine a value storage capacity with a relatively high degree of liquidity. “In most countries, bonds and equities are the two main asset classes in which pension assets were invested at the end of 2018, accounting for more than half of all investments in 32 out of 36 OECD countries, and 39 out of 46 other reporting jurisdictions.”[12]

The new structural presence of the asset management sector has important implications for the financial system as a whole. The large absorption capacities of asset managers represent ample opportunities for corporate and government borrowers in having these investors on the buy side of the securities markets. However, at the same time, the industry is operating under new tight constraints regarding the disbursements of cash. As securities have no intrinsic value, their ability to serve as investables with a determinate value storage capacity depends entirely on the degree to which their prices are held firm and thus made tangible, a condition which, in turn, depends on the rate and regularity with which cash is returned.

Here lies the crucial significance of the transformation of asset management from a subsector of finance serving individuals, into an industry of wealth management populated by large institutional players. When households were the representative type of investor in the securities markets, borrowers had far more room for maneuver over cash disbursements. This was partly because households, as small investors, were less able to constrain security issuing organizations, but also because they had less motivation to do so, given that they themselves were under no obligation to invest any part of their savings in financial securities.

By contrast, institutional asset managers are always obliged to keep a substantial proportion of the portfolios that are marketed to the public in the form of liquid securities. It is this obligation that explains why these investors have been instrumental in the establishment of a whole new type of transparency and governance infrastructure in the financial markets that can help guarantee the regularity with which borrowers return cash.

In the final analysis, all understanding of what sustains the dollar’s supremacy in the contemporary era comes down to an insight into the remarkable transformation that securities have undergone in line with the new governance rules and constraints that are now binding on security issuers. Without these constraints, promises of returning cash are always in danger of remaining fictitious: promises filled with empty air. With the new regulatory and governance constraints, securities have been transformed from mere promissory notes into genuinely solid stores of value; from being particles without matter, they become particles filled with matter. What this means is that when all the securities of a country’s organizations are aggregated together, this aggregation endows that country’s financial markets with mass and a corresponding power of attraction for asset managers and other institutional investors: the greater the mass, the greater the power of attraction.

No facet of this power is greater than that exerted by the US securities markets.

Foreign investors currently have trust in the US and in its legal and governance infrastructure of tradability debt, or futurity. Far from there not being “much of anything else” underpinning this trust, there is, on the contrary, much of everything underpinning it. What the US offers, and what no other region can do at present, is a huge and varied abundance of securities (not only equities but also bonds, including corporate, financial, Treasury, agency, and municipal bonds) in which foreign investors can store large amounts of funds and across which they can also move these large amounts relatively easily according to any change in circumstances.

Given the need for dollars as a means of accessing the US securities markets, it follows that just as it is the sheer depth and liquidity of these markets that attracts foreign institutional investors in droves, this attraction serves, in turn, to further amplify the depth and liquidity of the market for dollars itself. This development helps to explain why the dollar remains the most widely used currency in the execution of various cross-currency transactions. For example, the dollar is the funding currency of choice in foreign exchange swap transactions that currently account for nearly a half of the $6.6 trillion daily forex turnover and that are mostly used by banks to hedge exchange rate risks and meet short-term liquidity needs. Similarly, the sheer depth and liquidity of the dollar market means that even when those institutional investors holding globally diversified portfolios transfer funds from one set of non-dollar securities to another non-dollar set of securities, they usually do so indirectly, via the dollar, to contain the costs of these fund transfers.

How will the financial sanctions currently imposed on Russia impact this situation? The answer is, hardly at all. Of course, these measures will see an increase in the amount of pairwise emerging market economy (EME) currency transactions. Yet to put this increase into perspective, there needs to be an estimate of the percentage share of the $6.6 trillion daily forex turnover that these transactions had prior to the Ukraine crisis. Even a cursory look at the figures makes it clear that this share was negligible.

In the first place, EME cross-currency transactions relate primarily to trades in goods and services, and these trades, taken in conjunction with all other real-sector-related currency transactions, account for no more than 8% of total daily forex turnover.[13] Once one strips out the real-sector-related transactions conducted between the advanced market economies (AMEs) themselves and those between the latter and the EMEs, it turns out that the remaining inter-EME currency transactions barely register as a meaningful percentage ratio.

The combined share of all EME currencies in daily forex turnover is just 13%. Even then, in most cases the counter currency was not another EME currency but an AME currency such as the euro, the yen, the Australian dollar but most notably the US dollar. China’s yuan, although the highest-ranked EME currency in 2019 at 8th place in daily forex transactions, accounted for just 2% of these transactions and no less than 45% of these in turn had the dollar as the counter currency.

In sum, the Ukraine crisis will certainly lead to an increase in “non-dollar, non-euro” currency transactions, just as James Galbraith has argued. But the pre-crisis volume of these transactions was so vanishingly small as to invalidate any suggestion that this increase portends a multipolar currency system in the making.

3. An emergent multi-polar reserve currency system?

The same conclusion holds regarding predictions about the dollar’s primacy as a reserve currency. When Barry Eichengreen recently argued[14] that the Ukraine crisis will accelerate the movement towards a more multipolar international monetary system, his line of reasoning was as follows:

- the share of dollars in globally identified foreign exchange reserves has been trending down so that they now account for 59% of these reserves as opposed to the 70% figure of 20 years ago;

- the principal cause of this downward trend has been central banks’ diversification away from dollars towards the currencies of smaller economies such as Australia, Canada, Sweden, South Korea, and Singapore;

- this diversification into smaller currencies has been facilitated by the liquidity of these markets and hence the low costs of transacting in them, developments that have been made possible by the advent of electronic trading platforms and other financial innovations; and

- the principal motivation for this reserve diversification has been the central banks’ attraction to the higher yields that the smaller currencies offer in contrast to those offered by the large currencies.

There is nothing wrong with this explanation as to why central banks are diversifying their reserve portfolios to include more smaller currencies. Nor is there anything wrong with the IMF’s observation that these reserve portfolios may now include alternative currencies such as cryptocurrencies and digital currencies. What is wrong is that these narratives are presented in entirely self-enclosed terms rather than in the broader context of what any increased diversification signifies for the overall composition of central bank reserve portfolios.

As with all institutionally managed asset portfolios, foreign exchange reserve portfolios are organized according to a core-satellite structure, where the core segment in this case typically comprises US treasuries and the satellite segments comprise the higher-yielding securities of other governments.

A key question, therefore, is whether dollar reserves in central bank allocations will fall far enough below 59% to warrant the claim about an emergent multipolar reserve system? The answer to this question, in turn, boils down to the question of whether the dollar core segment in reserve portfolios will shrink to a size comparable with the non-dollar satellite segments. The expectations are that it will not.

Recall that the reason why institutional asset managers must hold a significant, if not majority, proportion of their portfolios in the form of financial securities, is that these best combine liquidity with a value storage capacity. Now, while the huge growth of the stock of securities in recent years has provided these institutional investors with abundant supplies of safe and portable value containers, the flip side of this growth in financial value storage capacity is that it has also provided hedge funds and other speculative vehicles with massive financial firepower when targeting national currencies that are perceived to be vulnerable. As was pointed out in a Group of Ten report back in 1993:

“the growth in the size, integration and agility of international financial markets has greatly increased the scale of pressure that can be exerted against an exchange rate when market sentiment shifts.”[15]

The European currencies felt the scale of that pressure in the EMS crisis of the summer of 1992, while all the Asian currencies (bar the yen) felt the scale of that pressure in the summer of 1997. Indeed, it was largely because of the unnerving experiences of these crises that there was a subsequent sharp increase in central bank foreign exchange reserves. From barely $0.5 trillion in 1995, the total amount of allocated reserves held by central banks had risen to $5.4 trillion by 2010, an amount that was more than doubled again to $11.8 trillion by 2020.[16]

In 2020, the dollar’s share of allocated reserves was indeed 59% as compared with its share of 70% in 2000. However, to say that there was a “trend decline” in the dollar’s share over this twenty-year period is misleading because it gives the impression of a continuous, year-on-year decline. Rather, while there was an initial downward adjustment of the dollar’s share to about 60% that occurred in the first few years following the introduction of the euro, from 2005 to 2020 that 60% share then remained stable, as did the euro’s share of 20%, and as did the remaining 20% collective share of several other smaller currencies.[17] The fundamental reason why the dollar has continued to maintain this 60% share of foreign exchange reserves even as these continue to grow exponentially in absolute terms comes down to the large mass of US Treasuries.

In today’s era, when the world’s capital markets are deep and highly integrated and when cross-currency capital movements accordingly combine huge scale with high mobility, central banks that are concerned to minimize the impact of these movements on their domestic currencies need to have in reserve financial securities that: (i) have a large and safe value storage capacity, (ii) are available in abundance, and thus (iii) are highly liquid. No other financial securities, and no other financial instruments including crypto and digital currencies, can match US Treasuries as regards these criteria.

If any EME-based central banks needed any reminder of this crucial fact, the events of early March 2020, provided it. By that time, the covid-19 pandemic’s negative impact on the global economy became clear to the world’s institutional investors, and they quickly withdrew funds amounting to over $100 billion from the EMEs in the space of days. That withdrawal was catastrophic for many of these countries, but its impact would have been even more devastating had their central banks not quickly intervened in their domestic currency markets with huge sales of the US Treasuries kept in their reserves.

Central banks around the world may well add the higher-yielding securities of other smaller currencies to their reserve portfolios. But can we seriously believe that, at a time when the world’s financial markets continue to grow in scale and become ever more closely integrated, and the threats posed by sudden surges of cross-border portfolio investments grow accordingly, that these central banks will risk substantially shrinking their core holdings of US Treasuries in the search for higher returns? Of course not.

4. The Primacy of the Dollar as an International Currency

On April 1st, 2022, the Bank of International Settlements launched its 13th Triennial Central Bank Survey of Foreign Exchange Transactions and OTC Derivatives Markets, the full results of which are due to be published in November. In the two full years between the 2019 survey and the current one, the world economy suffered its biggest shock since the great depression of the 1930s with the outbreak of the covid pandemic. In 2020, nominal world GDP fell from its 2019 figure of $87.4 trillion to $84.9 trillion, while the world’s combined bond and equity stocks increased by more than 15% from $200.9 trillion in 2019 to $234.3 trillion, an increase principally driven by the steep increase in government bond issuance on the one hand, and the increase in security prices fueled by monetary policy easing, on the other.

The story in 2021 appeared somewhat better, as nominal world GDP rose above its pre-pandemic level to $94.9 trillion, but the world’s combined equity and bond stocks again rose substantially, to reach over $241 trillion.[18] In both these Covid-impacted years, the US share of the world’s supplies of equities and bonds remained stable at around 40%. Thus, going by the observation that forex turnover volume is overwhelmingly driven by financial sector interests as distinct from those of the real sector, we can safely predict that the dollar’s share of the new 2022 figure for daily forex turnover will remain around 44%, while, at the other end of the spectrum, the combined percentage shares of all the EME currencies will stay around 13%, with China’s yuan share at 2%. In other words, our prediction is that the Ukraine crisis that broke out just after the commencement of the latest BIS triennial survey of forex turnover will have had no discernible impact on the currency breakdown of that turnover.

As to the longer term, we also predict that there will be no serious challenge to dollar supremacy in the foreseeable future because there will be no other regional or national currency that will have a sufficient backing mass of equity and debt securities to enable it to mount such a challenge over that time span. To support this prediction, we need only invoke the experience of the euro.

When this currency was launched in 1999, it was widely assumed that, as the currency of the world’s largest single market and trading bloc, it would soon overtake the dollar as the world’s premier international vehicle currency. Chinn and Frankel, for example, argued that the dollar would relinquish that position by 2015 not only because ‘the euro now exists as a more serious potential rival than the mark or yen were’ but also because ‘the United States by now has a 25-year history of chronic current account deficits and the dollar has a 35-year history of trend depreciation.’[19]

This argument could not have been more wrong, because while the euro’s share of daily forex turnover hovered around an average of 19% between 2001 and 2010, it subsequently fell to an average of 16% between that year and 2019, the principal reason for this reverse movement being the eurozone’s failure to supply the world’s large institutional investors with sufficient amounts of euro-denominated securities in which to park their funds.

This insufficiency is even starker in the case of the world’s EMEs that today collectively account for about 20% of world equity stocks and about 15% of world bonds stocks.[20] Many EMEs have too small a domestic real economic base to support securities markets of any appreciable size. Those EMEs that do have large production bases nevertheless continue to have relatively small financial markets principally, if not exclusively, because of continuing weaknesses in their domestic legal and governance infrastructures.

China’s situation illustrates the point. Although China’s equity and bond markets are by far the largest of any EME, these are still small by comparison with those of the US, largely because its governance standards are currently of uneven quality, high in some sub-categories (e.g. law and order, crime prevention) and low in others (e.g. protection of minority shareholders). As for the period ahead, China, which is still a middle-income developing country, will find it difficult to move all its legal and governance institutions rapidly in the required direction.

5. Conclusion

Nothing that has been said above should be taken to mean that we favor a dollar-centered international monetary system. Far from it, for we believe that there are many sound reasons, ranging from the political to the economic, why a multipolar system is desirable.

Desire, however, is not enough. Nor is it enough to hope that the foundations of dollar supremacy are so fragile that it is only a question of time and of another shock or two to the world political and economic order for those foundations to come tumbling down. On the contrary, those foundations are strong, which means that any attempts to elevate rival currencies to a position where they can challenge dollar supremacy must start by recognizing the reason why its foundations do remain strong. That reason comes down to the hard stuff of the financial securities markets, their constituent solid matter. The chief purpose of this short contribution has been to explain the nature of that matter.

References

Arslanalp, Serkan, Eichengreen, Barry and Simpson-Bell, Chima, 2022, “Dollar Dominance and the Rise of Nontraditional Reserve Currencies”, IMF Blog, 1 June 2022, https://blogs.imf.org/2022/06/01/dollar-dominance-and-the-rise-of-nontraditional-reserve-currencies/

BIS, 2019a, “12th Triennial Central Bank Survey of Foreign Exchange Transactions and OTC Derivatives Markets”, November.

BIS, 2019b, Quarterly Review, December.

Chinn, M. & Frankel, J. 2008, “Why the euro will rival the dollar”, International Finance, 11(1), 49–73.

Commons, John, 2017, Institutional Economics. Its Place in Political Economy, London, New York: Routledge.

Eichengreen, Barry, 2022, “Ukraine war accelerates the stealth erosion of dollar dominance”, Financial Times, 28 March 2022.

Galbraith, James, 2022, “A multipolar financial world is here”, INET, May 5th 2022; https://www.ineteconomics.org/perspectives/blog/the-dollar-system-in-a-multi-polar-world

Georgieva, Katarina, 2022, “The Future of Central Bank Money”, 2 February 2022, https://www.imf.org/en/News/Articles/2022/02/09/sp020922-the-future-of-money-gearing-up-for-central-bank-digital-currency

Group of Ten. (1993). International capital movements and foreign exchange markets: Report to the Ministers and Governors by the Group of Deputies. Basel, Switzerland: Bank for International Settlements.

IMF, 2017, Composition of Foreign Exchange Reserves, March.

IMF, 2021, Composition of Foreign Exchange Reserves, March.

Mehrling, Perry, 2010, The New Lombard Street, Princeton: Princeton University Press.

OECD, 2019, Pension Markets in Focus, p.29.

SIFMA, 2020, US Capital Markets Fact Book.

SIFMA, 2021, US Capital Markets Fact Book.

SIFMA, 2022, US Capital Markets Fact Book.

Strange, Susan, 1994, “Wake Up, Krasner! The World Has Changed”, Review of International Political Economy, 1:1.

UNCTAD, 2019, “Financing a Global Green New Deal”, Trade and Development Report.

https://unctad.org/webflyer/tr…

UNCTAD, 2022, “Tapering in a Time of Conflict”, TDR Update, March. https://unctad.org/webflyer/ta…

Notes

[1] Eichengreen, Barry, 2022, “Ukraine war accelerates the stealth erosion of dollar dominance”, Financial Times, 28 March 2022.

[2] Galbraith, James, 2022, “A multipolar financial world is here”, INET, 5 May; https://www.ineteconomics.org/perspectives/blog/the-dollar-system-in-a-multi-polar-world

[3] Arslanalp, Serkan, Eichengreen, Barry and Simpson-Bell, Chima, 2022, “Dollar Dominance and the Rise of Nontraditional Reserve Currencies”, IMF Blog, 1 June 2022, https://blogs.imf.org/2022/06/01/dollar-dominance-and-the-rise-of-nontraditional-reserve-currencies/

[4] Mehrling, Perry, 2010, The New Lombard Street, Princeton: Princeton University Press.

[5] Commons, John, 2017, Institutional Economics. Its Place in Political Economy, London, New York: Routledge.

[6] Strange, Susan, 1994, “Wake Up, Krasner! The World Has Changed”, Review of International Political Economy, 1:1.

[7] Galbraith, James, 2022, “A multipolar financial world is here”, INET, May 5th 2022.

[8] BIS, 2019a, 12th Triennial Central Bank Survey of Foreign Exchange Transactions and OTC Derivatives Markets, November.

[9] BIS calculates currency percentage shares out of 200%, to allow for the double counting of each currency pair. For simplicity, in what follows we halved the shares to give figures out of 100%.

[10] SIFMA, 2020, US Capital Markets Fact Book.

[11] SIFMA, 2021, US Capital Markets Fact Book.

[12] OECD, 2019, Pension Markets in Focus, p.29.

[13] BIS, 2019b, Quarterly Review, December.

[14] Eichengreen, Barry, 2022, “Ukraine war accelerates the stealth erosion of dollar dominance,” Financial Times, 28 March 2022.

[15] Group of Ten, 1993, p.33.

[16] IMF, 2017, Composition of Foreign Exchange Reserves, March. IMF, 2021, Composition of Foreign Exchange Reserves, March.

[17] UNCTAD, 2019, “Financing a Global Green New Deal”, Trade and Development Report.

[18] SIFMA, 2022, US Capital Markets Fact Book.

[19] Chinn, M. & Frankel, J. 2008, “Why the euro will rival the dollar”, International Finance, 11(1), p.51.

[20] UNCTAD, 2022, “Tapering in a Time of Conflict”, March. https://unctad.org/webflyer/ta…

“In general, nowhere does a longing for a transformation of the existing state of things arise more strongly than...

President Joe Biden’s efforts to tackle the climate crisis through executive action got an assist this week, courtesy of Missouri Rep. Cori Bush and Democrats on the House Appropriations Committee. One hundred million dollars in new funding, announced Tuesday alongside other measures in the upcoming Energy and Water Development and Related Agencies annual appropriations bill, would give the president resources to accelerate the production of solar panels, transformers, and other green technologies.

In the face of a stalled legislative agenda, Biden has turned to the Defense Production Act, invoking it twice this year to boost the production of green energy technology — once in April and again earlier this month. The DPA enables the president to make large adjustments to U.S. manufacturing policy — an authority that House progressives have been calling for Biden to use more aggressively. Senators of both parties, including Joe Manchin, D-W.Va., and Lisa Murkowski, R-Alaska, have also called on Biden to use the DPA to support green technology manufacturing — making passage into law, once the appropriations bill passes the House and is amended in the Senate, more likely.

The new funding would strengthen the effectiveness of Biden’s action and bolster precedent for using executive authority to fight the climate crisis. The text of the provision gives Biden wide latitude in deciding how exactly to use the funds in support of those technologies, as is standard for policy created through the DPA.

The measure’s inclusion was the result of a last-minute, behind-the-scenes effort by Bush, whose office has regularly led efforts for bold climate legislation. In a statement provided to The Intercept, Bush praised the inclusion of the funding. “The DPA is one of the most important tools we have to take on high gas prices and the climate crisis at the same time,” she said. “To protect all of our communities, particularly those with the greatest need, we must take robust measures to transition to renewable energy and lower prices as quickly as possible. This funding helps us achieve that.”

Progressives in Congress have called on Biden to use his broad executive authority to make headway on a suite of Democratic priorities. In March, the Congressional Progressive Caucus pushed Biden to invoke the DPA as part of an aggressive administrative response to the climate crisis. Bush also introduced similar legislation with Sen. Bernie Sanders, I-Vt., and Rep. Jason Crow, D-Colo., to bolster the Defense Production Act earlier this year.

But while House leadership and the White House have been broadly supportive of the provision, Biden’s latest invocation of the DPA left members of the House Appropriations Committee with little time to account for the new policy in ongoing negotiations. After individual Appropriations subcommittees receive their top-line figures, which in this case roughly coincided with Biden’s announcement at the beginning of June, it is difficult to secure funding for new priorities. By coordinating discussions among the White House, House Speaker Nancy Pelosi’s office, and Rep. Marcy Kaptur, D-Ohio, chair of the House Appropriations Subcommittee on Energy and Water Development, Bush — a first-term representative — exerted a rare amount of influence over a process that is usually guided by senior members of the caucus.

In a press release marking the subcommittee’s release of the draft bill, Kaptur touted the inclusion of the DPA funding, indicating that Bush’s efforts have significant buy-in from key players in the appropriations process. “From unleashing energy innovation and utilizing the Defense Production Act to boost domestic manufacturing, to responsibly managing water resources and tackling the crisis of climate change – this Energy and Water bill delivers for America’s needs in the 21st century,” Kaptur said.

If the new funding survives ongoing negotiations, it may embolden progressives to demand more executive action from the administration. Legislation that endorses Biden’s use of the DPA to support green energy technology would provide the administration with a layer of insulation from legal challenges over the issue going forward. If Democrats lose one or both chambers of Congress in November, that precedent could be key to ensuring that the administration has tools to continue fighting the climate crisis.

The post Rep. Cori Bush Boosts Biden’s Efforts to Fight Climate Change With Executive Authority appeared first on The Intercept.